A pay stub template for 1099 employee payment information enables you to record your earnings, various kinds of taxes withheld, deductions, as well as other payroll transactions that pertain to a certain payment period. If you’re receiving payment from your own company, utilize cheaper and more efficient web-based paystub creators that provide all the details you want immediately, no matter the time or location. You may approach a financial institution with the paystub, use it as evidence of a regular salary, and prove yourself worthy of various forms of lending including mortgages and car loans.

The information you enter in any paystub generator depends on your custom payroll needs, but the steps to take and generate the report don’t differ significantly from one provider to another. Below is how to prepare and produce your 1099 employee paystub quickly without trouble:

1. The first step involves gathering all the information to be captured into your paystub template before you can proceed to your online generator once you’re prepared. First figure out the purpose of the data entry spaces that the web form offers so you can begin typing your information. Remember to read the labels as they have descriptions for the purpose of each text box or field.

2. Then, type in your salary details. This information may be in the form of a per-hour rate or fixed amount that remains the same in the payment period for which you’re creating this paystub.

3. Be sure to indicate the commencement and end of the pay duration. This is where you also include in afterhours duty or holiday time that’s being considered. Supply correct values here as you’ll use them to work out your year-to-date hours. Pay attention to any relevant deductions.

4. Enter all federal, local, and state taxes for withholding. This template will also capture Medicare and social security remissions.

5. Prior to printing, review the check stub after filling in all relevant information. Consider the significance of examining every single field that carries a numerical value to confirm its accuracy. Reviewing the paystub using a checklist may prove very important in the end. If you’re satisfied with the logic of all computations and sums, including overall pay and net salary, you can go ahead and print the pay stub.

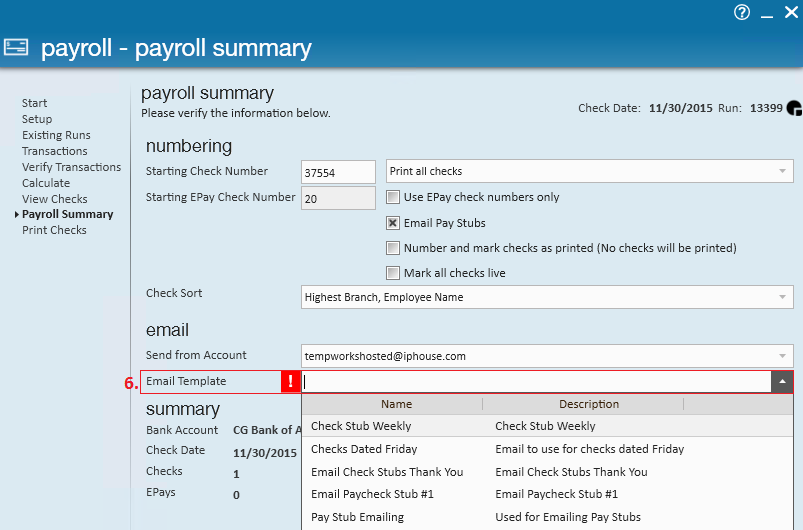

6. The paycheck stub creator can also deliver an electronic version of the slip you just created to your email address. Such a digital version comes to the rescue later on when you need physical copies for the same payment period, without having to refer to the pay slip maker.

So, you’ll have it easy with a pay stub template for 1099 employee steady payment records. The online template is available 24/7 from all locations.

What You Should Know About Funds This Year